BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows, empowering ANY business.

Everything You Need To Know About Payment Orchestration

Payment orchestration is the next big trend in online payments, but why? What is it and how does it improve upon the traditional payment service providers (PSPs) that have dominated the market for years? Below we’ll discuss what payment orchestration is and how it can benefit your online business.

What is Payment Orchestration?

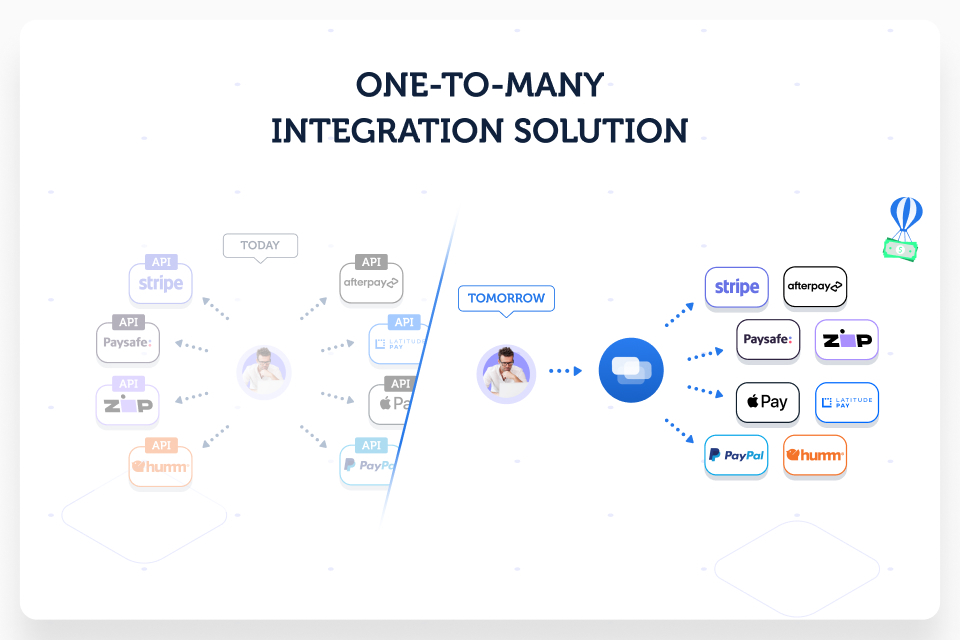

Payment orchestration doesn’t do away with PSPs, but rather, works with multiple processors and then routes payments for individual transactions to the most efficient one. Large-scale online merchants have been working this way for years, since they have the budgets to employ in-house teams that create contracts and integrate with multiple processors.

Small and medium-sized businesses, however, don’t usually have the “luxury” of hiring an in-house department to handle payment orchestration. The option they have traditionally been left with has been high-priced PSPs that employ a one-size-fits-all solution. This method slows the checkout process for the consumer and charges high fees to the merchant.

Payment orchestration platforms like BridgerPay, on the other hand, do several things. They:

- Eliminate the need for a costly in-house team

- Create a fast, convenient checkout method for consumers

- Reduce merchant fees

How can a payment orchestration platform do all this? Through infrastructure, a unified checkout experience, optimization, and data reporting efficiency.

Infrastructure

For the past decade, mid-market businesses and SMBs have managed their online payments through one PSP, since using multiple connections proved too costly and complicated. With payment orchestration, these businesses can perform all the necessary connections to complete an online payment in one place.

The result? An efficient, streamlined payment system that increases revenue and security while providing a more convenient checkout system for the consumer. When this happens, business owners will have more time to focus on other things, like development, advertising, etc.

Unified Checkout Experience

Payment orchestration creates a seamless checkout experience for both customers and merchants. BridgerPay’s payment orchestration platform does this by allowing customers to embed their solution or add its REST API to their stack. The result is that the merchant cashier has the same look and feel as the rest of the website.

Payment orchestration also enables online businesses to let their customers pay in local currencies. Tools like the Bridger Currency Converter allow the conversions to happen on the merchant’s end, not on the end of the PSP. This can lead to reduced cart abandonment, since customers will be able to use their preferred local wallets, and increased revenue for merchants.

Optimization

Payment orchestration routes payments through the most efficient processor, as opposed to routing all payments through the same processor. For example, if an online store needs to receive a payment from a US-based customer and a Europe-based customer, payment orchestration means that each of those payments gets routed to the most efficient processor.

Bridger Retry routes different payments to different processors and reroutes them automatically in case a payment is declined, which reduces failed transactions and the cart abandonment that usually follows. The Bridger Router allows merchants to set up routing rules according to currency, region, and transaction amount, which increases transaction speed and decreases the cost to the merchant.

Data Reporting

Payment orchestration provides a 360-degree view of a merchant’s transactions and data, since all PSPs are managed in the same place. Data reports suddenly become easier to access. Merchants can get a full view of all essential data, including approval ratios for all payment gateways, declined transactions, cart abandonment, total transactions, and more.

Online Retail Growth

According to Statista, global online retail totaled $3.53 trillion in 2019. By 2022, that number is projected to reach $6.54 million. While small to mid-sized businesses may not have needed payment orchestration in the past, as more people turn to online shopping, the need is now apparent. For online merchants that needed it but didn’t have the budget, payment orchestration is now affordable.

Payment orchestration can help online retailers reduce the cost of payment processing and the rate of cart abandonment, increase long-term profits, and make the consumer experience more convenient. As one solution that can achieve all of these goals, the question isn’t why should you go with payment orchestration, but how fast can you implement it.