BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows, empowering ANY business.

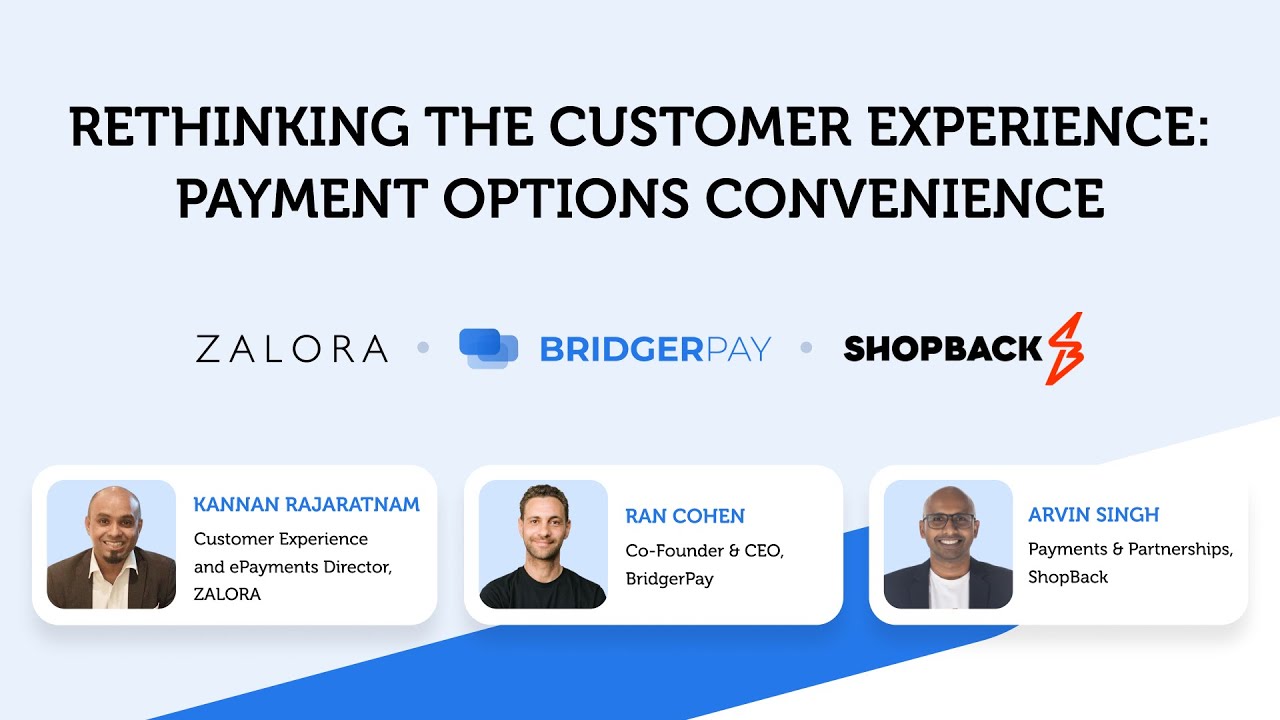

Rethinking the Customer Experience: Payment Options Convenience

What Problem Was Zalora Facing?

These are the facts. Before the pandemic, Buy Now, Pay Later (BNPL) wasn’t a big thing. During and after the pandemic, BNPL has exploded. From a retailer/merchant perspective, Zalora has seen a huge increase in BNPL demand year-on-year. During the pandemic, Zalora wanted to help their clients, Kannan Rajaratnam said “the way we (Zalora) looked at it was that if you are someone who has to work from home, and maybe you need a new desk, and you don’t want to put the cash up front or use all the credit limit on your card, BNPL would help reduce the financial pressure. Also, with the installments, you can comfortably wait for your salary to come in before settling the payment. We wanted to give users the ability to better manage their cash flow. The idea was not to encourage customers to split payments, but to make sure they were able to get the essentials upfront.”

Zalora decided to go for Shopback PayLater (formerly Hoolah) as their BNPL provider. The issue was that, as Kannan put it, Zalora “had constraints on how many tech resources it could deploy for the integration, and we knew we didn’t have the firepower to do the heavy lifting ourselves and launch in just two weeks”. Much of the complications were due to the fact that Zalora had very specific needs in terms of customization and customer experience.

What Was the Need for the Solution?

Shopback PayLater

The state-of-the-art Buy Now, Pay Later provider, market leader in Southeast Asia. Zalora needed a provider that could cover all its geographies, and Shopback fit the bill perfectly.

BridgerPay

The payment operations layer that seamlessly connects any payment provider (Shopback in this case) to the merchant’s checkout, according to its business logic, and without any effort from the merchant’s side.

How Was the Solution Deployed?

As with all its customers, BridgerPay did all the heavy lifting when it came down to the integration process, taking care of everything, from the main requirements to the finest details. Kannan said that “there was a lot of customization in what we needed to do, especially in how we handle customer data, that was specific to Zalora. We just had to email BridgerPay and ask them, and it was done.”

From the Shopback side, Arvin Singh said that “it was fairly straightforward (to connect to BridgerPay). Essentially, it was just API documentation that we needed to share with the BridgerPay team. So, a bit of guidance from our side, a bit of support throughout the process, and it was very fast to work together as a group to make sure that we could deliver”.

All in all, the whole go-to-market time was less than two weeks, and Zalora was able to launch its BNPL service in record time.

What Were the Results?

Buy Now, Pay Later revenue for Zalora was around 7-8% at launch and now is 13-15%. Let that sink in for a minute. With BridgerPay and Shopback, Zalora doubled its revenue from BNPL and was able to better manage its tech resources. According to Kannan “BridgerPay freed up a lot of our time and resources and made sure that we could focus on what mattered to us, which was planning the campaigns. We took our focus off the integration side of things, and focused on the business side.”

Improved Customer Experience and Productivity

From the customer point of view, Zalora received stellar feedback from customers, and “they thought it was super-helpful”. The experience is seamless, and the user is not able to see that it’s a three-layer integration (Zalora checkout > BridgerPay > ShopBack). Also, for Zalora’s team the view in the backend (in BridgerPay’s Admin) is very intuitive, and they can easily identify the transaction and make any changes needed. Kannan summed it up by saying that “overall, it’s a perfect experience for both the customer and the merchant.”

Where does Zalora use BNPL?

At present, Zalora is able to offer BNPL In all the markets it operates in, also because Shopback supports them all.

In some markets traction and velocity are slightly better, but overall all markets show a strong demand for BNPL, hence Zalora is seeing increased spending and cart size across the board. In fact, Kannan said that Zalora “saw a lot of traffic coming from Shopback, partly because of the ATL (Above-the-Line) marketing campaigns they did for us.”

What’s in Store for the Future?

From Zalora

Zalora is a customer-centric organization that doubles down on making the payment flow seamless for the customer, especially with existing customers. In Kannan’s words “with BridgerPay we can tokenize the information we have about the customer and make their experience easier each time they return by making the checkout seamless.”

From Shopback

Shopback is working on a lot of fixes, adjustments, and tweaks to make the customer experience cleaner. Arvin said that “some of the things may not be obvious, but they really help to shorten the customer experience from the start to the end of the journey. One of the most recent features that we deployed was to let the customer complete the transaction directly within the browser.”

All in all, Shopback will be focusing on ways to give users more flexibility without adding more steps to the checkout flow.

From BridgerPay

BridgerPay is able to eliminate any redundant clicks and take care of all the data that needs to be transferred, so that the customer experience is as fluid and intuitive as possible, and users never leave the merchant’s website. The company will keep on improving these features, and adding new ones, always keeping up with and creating the latest technology.

Final Words

Kannan Rajaratnam (Customer Experience and ePayments Director, ZALORA)

We are very thankful to BridgerPay for enabling us to go live with Shopback in such a short time, and also for delivering the many changes and customizations we required, even the most peculiar ones!

Arvin Singh (Payments & Partnerships, ShopBack)

At ShopBack, we focus on delivering value to our partners, merchants and users as effectively as possible. Through this collaboration, we were able to integrate with BridgerPay seamlessly and provide Zalora’s customers with a flexible payment option (ShopBack Buy Now Pay Later) without compromising the customer experience.

Ran Cohen (Co-Founder & CEO, BridgerPay)

“BridgerPay is proud to be making a difference for merchants and payment providers worldwide. Zalora and Shopback are wonderful examples of great companies that were brought together by our technology layer and scaled faster because of it.”

About the Companies

Zalora

ZALORA is Asia’s Online Fashion and Lifestyle Destination. Founded in 2012, the company has a presence in Singapore, Indonesia, Malaysia, the Philippines, Hong Kong and Taiwan. ZALORA is part of the Global Fashion Group, the world’s leader in online fashion for emerging markets. ZALORA offers an extensive collection of top international and local brands and products across apparel, shoes, accessories, and beauty categories for men and women. Offering up to 30-day free returns, speedy deliveries as fast as 3 hours, free delivery over certain spend, and multiple payment methods, and a loyalty subscription program Znow offering unlimited free and fast delivery. ZALORA is the online shopping destination with endless fashion and lifestyle possibilities.

Shopback

Shopback built a demand generation platform that in 2021 alone created 450 million shopping trips for partner merchants. Their goal is for customers to feel that they win every time they use Shopback, whether it’s through cashback or any other feature, like PayLater.

BridgerPay

BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows with a Lego-like interface, empowering ANY business to scale their payments, insights, and revenue with a codeless, unified, and agnostic software.