BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows, empowering ANY business.

What Is ACH Payment & How Does ACH Transfer Work?

Let’s start by defining ACH: Automated Clearing House is an electronic money transfer method among banks allowing online money transfers between different financial institutions.

ACH transfers do not happen in real-time, but they are low-cost, reliable, and readily available to those who hold a US bank account.

According to Nacha ACH payments in B2B have increased by over 33% in 2021 and, in general, they have increased in volume for seven consecutive years.

In the US, there are mainly two types of electronic payment methods for transferring funds directly between bank accounts: ACH payment method (Automated Clearing House) and Wire Transfer.

To find out more about both methods, read this article!

What Is ACH Payment Method?

The Automated Clearing House (ACH) is a network of financial institutions that allows funds to be transferred electronically between accounts. It is run by the National Automated Clearing House Association (NACHA) and it is exclusive to the US.

As ACH is typically used for low-value transfers, one should always be aware of their bank's policies regarding ACH payment transfers online, because there may be limits on transfer value and restrictions on the reasons for transferring the funds.

There are two types of ACH transfer:

- ACH Direct Deposits – When an institution pays the consumer directly (for example for payroll purposes)

- ACH Direct Payments – When the consumer (or a business) initiates the payment

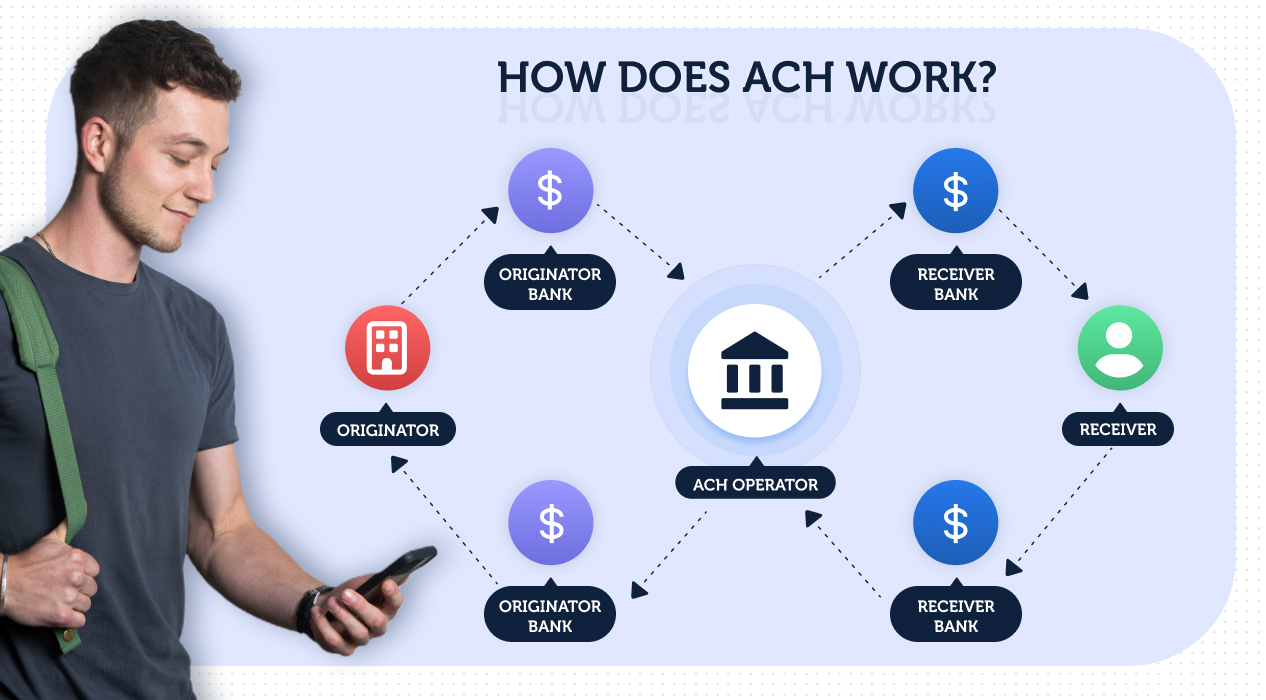

How Does ACH Transfer Work?

ACH transfer is a way to make payments between banks, and it's pretty easy. The first thing you have to do is to make sure that the receiving bank is in the ACH Network.

ACH transfers can also be used to move money from a checking account into a savings account or CDs (Certification of deposits).

Automated Clearing House transfers are not instant because the request needs to go through several steps:

- The request for ACH is made to the bank

- The bank submits the request to the ACH operator

- The ACH operator sends the request to the payer’s bank

- The payer’s bank pulls the funds from the correct account and sends them to the ACH operator

- The ACH Operator deposits the funds in the bank account of the person who made the request

What Is a Wire Transfer?

A Wire Transfer is an electronic payment method that allows you to send money to other accounts. One of the drawbacks of a Wire Transfer is that if you want to send money within the same day, you will need to pay extra.

Wire Transfer is not limited to the US like ACH Transfers, and there are normally two types:

- Domestic: You can send money within your country.

- International: You can send money to a country different than yours. In the US, there is usually a minimum amount for the transfer, so you should check with your bank.

Wire transfers are instant because they don’t have to move through a clearinghouse for processing.

ACH Payment Vs. Wire: Here Are Some Differences

Though both electronic methods help transfer money, there are some differences that you need to take into account so you know which one is better for you.

Here are some factors differentiating ACH payment vs. Wire:

Availability

ACH money transfer online is available for US domestic purposes only. If you want to send money abroad, you will have to use an international wire transfer.

Processing Time

ACH payment processing time is usually one or more business days, while wire transfers can be processed within the same day. However, NACHA recently announced that most ACH payments should be settled within 2 business days.

Transfer limits

There are payment transfer limits applied to both electronic methods. You can check with your bank to learn about these limits.

Security

Security is the most important factor to consider when it comes to deciding which payment method is better. ACH payment method and Wire Transfer both offer high security when it comes to money transfer.

The institutions that manage wire and ACH transfers offer an extended protection layer to make sure the banking information of each user is encrypted to prevent hacking.

You also need to verify your banking information before making any transaction. Unfortunately, scams do happen and both wire transfers and ACH payments can be stopped. The important thing is to act fast before the transfer takes place.

Posting times

An ACH payment transfer doesn’t allow you to accept ACH payments instantly. There will be a “pending” status and the fund will not be released until they clear the ACH system. On the other hand, wire transfers can be instant!

Reversals

ACH money transfers allow you to reverse the transaction if there has been an error. You have 5 business days to submit your reversal request. However, wire transfer does not allow that once the receiving bank has accepted it, unless in very specific circumstances.

Fees

When it comes to transaction fees, most ACH money transfers are free. However, you may have to pay a fee when you pay bills or send the money to a different bank.

When doing a wire transfer, there is usually a fee that can range between $10 and $50 in the US (many banks in Europe offer free wire transfers within the country).

The Bottom Line

When it comes to payment methods, there are many ways to choose. The important thing is figuring out what works best for your business and your customers.

When it comes to choosing an ACH payment method, you'll want to consider the following:

- The speed with which the transaction will get processed

- The cost of the transaction (some ACH transfers may not be free)

- The type of bank account you want to use (ACH has different options for different types of accounts and only work in the US)

In the same way, there are certain benefits to using wire transfers as well, such as performing fast international transactions, especially for larger sums.

In the end, it all comes down to your payment-handling needs, but offering direct payment from your customers’ bank accounts is a smart move, especially in the EU.

Offer Bank Transfers in Your Checkout

Did you know that through BridgerPay you can offer bank transfer payments in your checkout? We connect to payment providers that use common bank transfer schemes like SEPA or Open Banking (e.g. Volt.io, iDeal, or SEPA via BlueSnap) to offer instant payments.

Furthermore, your customers can also request to pay through a classic offline wire transfer: right now we are connected to the BlueSnap APM. The user just needs to input a few details at checkout and they will get the right bank account details for their country dynamically and in real-time. Unlike SEPA and Open Banking, which have yet to reach the US, the offline wire transfer option is available for customers in the United States as well.