BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows, empowering ANY business.

Payment Gateway vs Payment Processor

Payment Gateway Vs Payment Processor

The world is becoming increasingly digital, especially when payments are concerned. So, it is no wonder that consumers ask for easier ways to pay, and merchants want to streamline their payment processing!

To make the payment experience worthwhile, it is important to offer flexibility to customers at checkout.

If you are a merchant or an eCommerce business owner, you have an overwhelming amount of options when it comes to payment processing. One of the first things you need to learn is the difference between Payment Gateway & Payment Processor! Trust us, it will make your business choices a lot easier.

In this article, we’ll explain everything related to both terms! But first, we need to tell you a little bit about the parties involved in the journey that every transaction makes before it lands in your pocket. Continue reading to learn more.

What is necessary for a successful transaction?

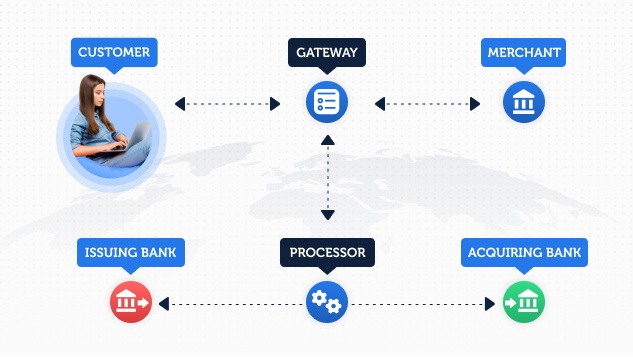

Any card transaction needs four elements before it can happen:

- The merchant (yeah, that’s you)

- The customer

- The issuing bank (that issued the customer’s card)

- The acquiring bank (your bank, which is going to receive the money)

Now that that’s out of the way, let’s see where payment gateways and payment processors fit in the exchange of funds.

What is a Payment Gateway?

A Payment gateway is a service that securely transmits the payment data to the payment processor so that the transaction can take place. Think of it as a virtual POS terminal for CNP (card-not-present) transactions.

A payment gateway is a platform that receives the payments’ data, sends them to the payment processor (or acquirer bank in case of CC transactions), and communicates the approval (or rejection) to you and your users. This can be done in three ways:

- By redirecting the user to the gateway’s payment page (not advisable as it leads customers out of your website and disrupts the payment experience)

- By self-hosting the gateway, collecting the payment information in your website and relaying it to the gateway through a URL

- By collecting the payment information in your website and communicating it to the gateway through API

Why use a payment gateway? Because they are tools that make your life much simpler. First, they take care of encryption and help you stay compliant with the latest security regulations like PCI (which saves you a ton of money). Secondly, they allow you to offer more payment flexibility, without being tied down to a single payment processor. Third, they offer a nice (well… mostly nice, but we’ll get to that later) user interface for the collection of customers’ data.

The biggest and most advanced payment gateways will also provide you with transaction and account management tools, which speed up tasks such as reconciliation, refunds, and reporting.

Payment Gateways with and without Acquirer Networks

Pure breed payment gateways are not financial institutions, and as such, they can only relay the information to a payment processor, not move funds themselves. Then, how is it that companies like Stripe, Checkout.com, and Mollie market themselves as payment gateways and also allow you to accept credit card payments without further connections?

Simple, because they are licensed financial institutions with acquirer networks (i.e., agreements with one or many banks to process payments). They really are a gateway, an aggregator, and in some cases an MSO. Confused? Don't worry, keep on reading, and we'll explain everything. 😁

The Advantages of a Dedicated Payment Gateway

The main benefit of using a dedicated gateway solution, instead of the one offered by your processor, is the flexibility. Particularly:

- Dedicated gateways and payment operations platforms allow you to localize your checkout by using multiple processors for accepting credit card transactions

- Direct API integration to any payment method, including BNPL, Open Banking solutions, APMs, and Crypto

- Having multiple credit card processors means that, if your platform supports the technology, you can retry declined card transactions in real-time and rescue revenue

- Advanced look and feel customization of your checkout

What is a Payment Processor?

A Payment Processor is a company that facilitates the actual exchange of funds (that is the debiting of one account and the crediting of another). These companies communicate with the issuing bank and the acquiring bank to ensure secure and successful transactions between you and your customers. You can choose the payment processor that works best for your business.

Payment processors also provide their clients with services like fraud detection and fraud prevention, which are meant to further increase security and approval rates.

Different Types of Payment Processors

The world of payment processors is very complicated and full of gray areas, where one processor can fall into multiple categories. We'll try to explain the key terms and give you a good understanding of how different processors handle funds during transactions.

The common characteristic is that all payment processors are licensed financial institutions, hence they are allowed to handle money.

Before we start, it's important that we define a few key terms, as it's impossible to understand payment processors without these.

Money Service Operator (MSO) Any person or company that provides money changing and/or remittance services is a Money Service Operator. MSOs need to be licensed by the government and help businesses exchange the money from their cross-border transactions in their local currency.

The revenue model of most MSOs is to charge a percentage fee on the amount exchanged.

Merchant ID (MID) This is a unique identification number that is assigned to a business by the processing bank. It is necessary for the systems to understand where to send funds.

If you are thinking "Cool, I'll just go to the bank and get myself a MID"... think again. MIDs are not handed out lightly and normally involve a hefty investment. This is why businesses usually obtain their MIDs through a Merchant Services Provider, or an Aggregator (continue reading below for more about aggregators).

Now, let's look at the different payment processors:

Banks

In the vast majority of cases, a bank (the acquirer bank) is the processor of a transaction, no matter the route a payment follows. They can verify the authenticity of the details, make sure that the client has sufficient funds, move the money, and settle the payment.

Except for some eWallets, all payment processors (that are not a bank themselves) have agreements with one or more banking institutions (acquirer networks) in order to be able to move the funds.

Payment Aggregators

As we said, you don't just walk into a bank and ask for a Merchant ID. This is where aggregators come into play. They will get a MID (or several MIDs with different banks in an acquiring network), and process transactions from all their merchants as sub-merchants. In other words, all the transactions will be settled by the acquiring bank under the same MID, and then the aggregator will distribute the money to the right sub-merchants.

Often payment aggregators will provide merchants with individual MIDs, but it's important to understand that they are all connected to the same master account.

The settlement from the aggregator to your business depends on the aggregator's model, it can be daily, weekly, or sometimes monthly.

The pros of using an aggregator are that they are quick to set up and it's easier to get accepted as a merchant. However, if you are a large enterprise, you might want to consider the direct route of obtaining a Merchant ID in order to save on fees and achieve quicker settlements.

The most famous example of a payment aggregator is probably Stripe (which incidentally is also a payment gateway).

Processors and MSOs (Money Service Operators)

We know that most payment processors rely on agreements with acquirer banks to process transactions. If the transaction happens to be cross-borders (i.e., the currency of the customer is different from that of the merchant) there also needs to be a currency exchange.

This is where MSOs come into play. And it's also where things might get fairly expensive. Think about this: the payment processor has its own set of fees, but is also paying a fee to the MSO, hence it charges you extra in order to make up for that expense. The result is that your margins shrink considerably.

An alternative that payment processors have found is to get an MSO license themselves, so they can deal with local banks directly and exchange currency at the market rate, with no additional fees. This allows them to keep their fees lower, even for cross-border payments.

Pro-tip: if you know that you are going to have a considerable amount of clients from a specific country abroad, make sure your payment processor can exchange the currency of that country without slapping you with insane fees.

eWallets

Also known as e-wallets, they fall under the category of Alternative Payment Methods (APMs). eWallets are often connected directly to a person's bank account (or card) and allow them to complete purchases without entering card details.

Like all payment processors, eWallets are a licensed financial institution and they can handle money.

The main difference with card processors is that they may not have an acquiring bank behind them (in reality, most eWallets have agreements with acquirers as well).

The most famous eWallet is without a doubt PayPal, but BNPL providers like Klarna, AfterPay, Humm, and Zip are also eWallets.

Top tip: We recommend choosing a payment processor that has experience with your industry, so they can easily deal with any specific issue you might be facing (check out our awesome Connections page, which is a search engine to help you find the best payment provider for your needs.)

What Are the Differences Between Payment Gateways & Payment Processors?

Let’s be clear: Payment gateways and payment processors are two different things. You can find some resources that use the terms interchangeably, but that is wrong.

In a nutshell, the payment gateway facilitates a transaction made on your website by taking it to the payment processor; then, the payment processor communicates with the banks.

The main difference is that payment processors are licensed as financial institutions, while gateways are not. It’s important to take into account that also wallets like PayPal are financial institutions and processors.

How Do Payment Gateways & Payment Processors Work Together?

Payment processors and payment gateways work together to allow you to accept customer payments.

As we have seen, a payment gateway securely shares payment data with the payment processor, which then talks to the issuing and acquiring banks. If you are processing transactions physically at your point of sale, then you can use just a payment processor, but if you accept payments online you need both a payment gateway and a payment processor.

Often the line between payment gateways and payment processors gets blurry simply because most processors offer gateways as well. When you decide to sign an agreement with a card processor, they will most likely offer you the processing agreement and the gateway agreement. You could waive the gateway agreement and use your own solution, or a payment operations platform such as BridgerPay to connect all the processors you need through just one API integration.

Why should you choose to use a dedicated payment gateway solution? Because sometimes out-of-the-box gateways can have a clumsy UX, with lots of redirects that customers hate. A dedicated gateway platform allows you to:

- Keep the payment experience consistent, independently of the payment processor

- Avoid annoying redirects and popups

- Manage and report on all your transaction from a single back-office

In other words, the beauty of it is that with modern technology, the whole process can be automated so that you don't have to worry about anything but marketing and sales!

Should I Use Multiple Payment Gateways or Processors?

The answer is increasingly becoming: yes, yes, a thousand times yes!

Why? To improve your acceptance rates!

Improve Acceptance Rates with Multiple Payment Gateways and Processors

Let’s give a practical example: your credit card processor has an agreement with an acquiring bank in the US. That bank will decline most payments from Latin America. It’s not fair, but it’s the state of the matter. If you connect a second processor that has an agreement with a bank in Latin America, you can instantly bump up your acceptance rates by routing all transactions from South America to that processor. Someone say “tequila”? 🥂

When you connect two or more processors through a payment operation platform (which is, among other things, a unified super-gateway) you can also use automatic transaction retry technologies to rescue declined transactions in real-time. If a payment gets declined, the gateways simply submit the same transaction to another processor, increasing the chances of approval dramatically (our data show that this type of technology can recover up to 30% of declined transactions).

The Bottom Line

Payment processors and payment gateway services go hand in hand, and you need both if you have an online store. They help you run your business smoothly, facilitating you and your customers in the payment process.

“Super-gateways” like BridgerPay’s payment operations platform, can help you reap all the benefits from leveraging multiple payment processors while maintaining your UX, checkout, back-office, and reporting unified. In other words, they enable you to take full control of your payment stack and optimize it through an intuitive, Lego-like interface.

We hope you have learned enough about payment gateways vs payment processors in this post. Hit us up if you have more questions!