BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows, empowering ANY business.

Spending Made Easy: Buy Now Pay Later Rules the Holidays

An Afterpay-commissioned study shows that BNPL spending has increased by 230% during Black Friday and Cyber Monday. All signs suggest that it will be the same with Christmas shopping. BNPL is becoming a must-have in every merchant’s payment stack. BridgerPay has got you covered.

Buy Now Pay Later (BNPL) providers like Afterpay are growing at an exponential rate, bringing benefits to both consumers and merchants. Orders through Afterpay have gone up by a staggering 34% since last year. With another pandemic-hit holiday season, we are expecting this number to grow even more as Christmas approaches. Merchants that don’t offer a BNPL solution may run the risk of being left out as consumers choose those that do. With BridgerPay you can connect to the BNPL providers that best suit your needs.

Benefits of BNPL

BNPL providers are PSPs (read all about Payment Service Providers here) that offer interest-free installments on small purchases. In a digital payments world governed by hefty card fees, BNPL means peace of mind for both consumers and merchants because splitting purchases leads to:

- Larger carts

- Easier budgeting

- Fewer transaction declines

- Cutting credit card costs from 4.4% to 0.1% on average

Where BridgerPay fits in

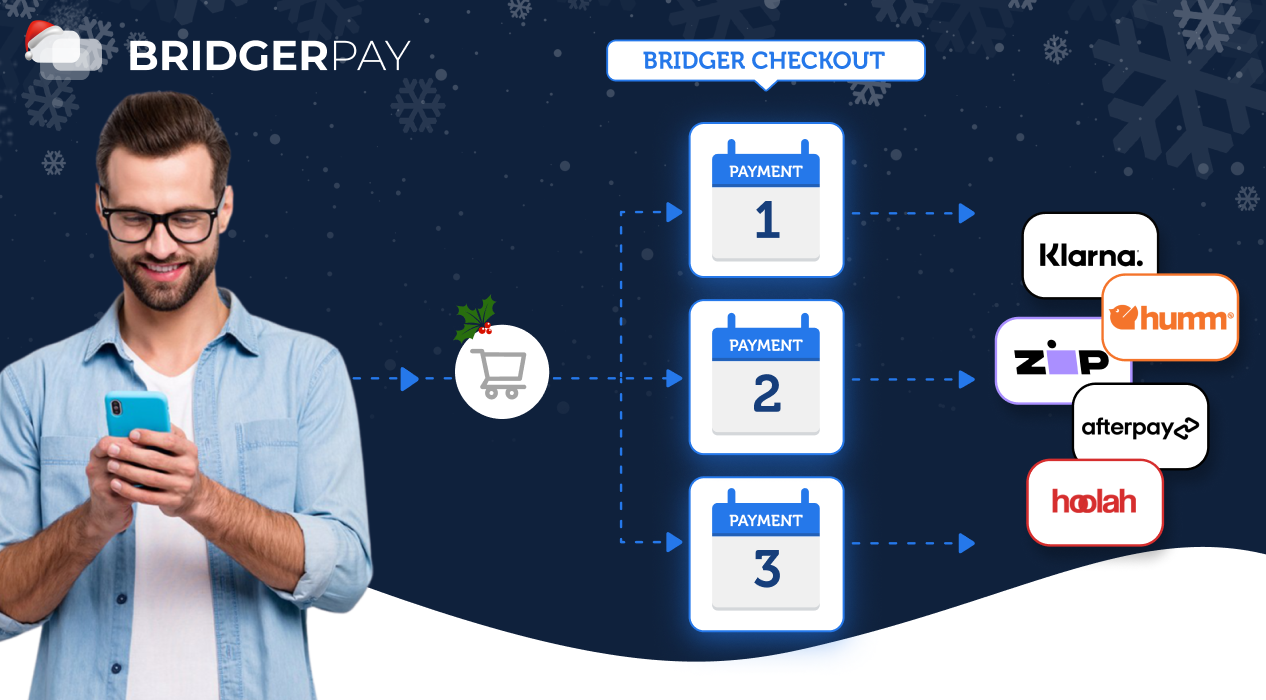

BridgerPay empowers you to choose the perfect combination of PSPs to offer your customers the best payment experience. We apply the same principle to BNPL. We already offer an extensive range of BNPL providers, we will add more soon, and can connect the ones you need on-demand. This means that you don’t have to settle for one BNPL method, you can use the preferred BNPL in every region you sell your product.

You can already connect:

- Afterpay (US)

- Klarna (Europe, Australia, US)

- Hoolah (Asia)

- Limepay (Australia)

- POLi (Australia, New Zeland)

- LatitudePay (Australia, New Zeland)

- Till Payments (Australia)

- Zip (Australia, New Zeland, Mexico, UK, US, Canada)

- Humm (Australia)

Localize your BNPL

BridgerPay empowers you to localize your BNPL offer. Through Bridger Router you can show your customers only the most relevant BNPL method. By localizing your payments offer you will increase your conversion rate and improve the customer experience. Pretty cool, uh?

Ready to start orchestrating your payments? Get started today!