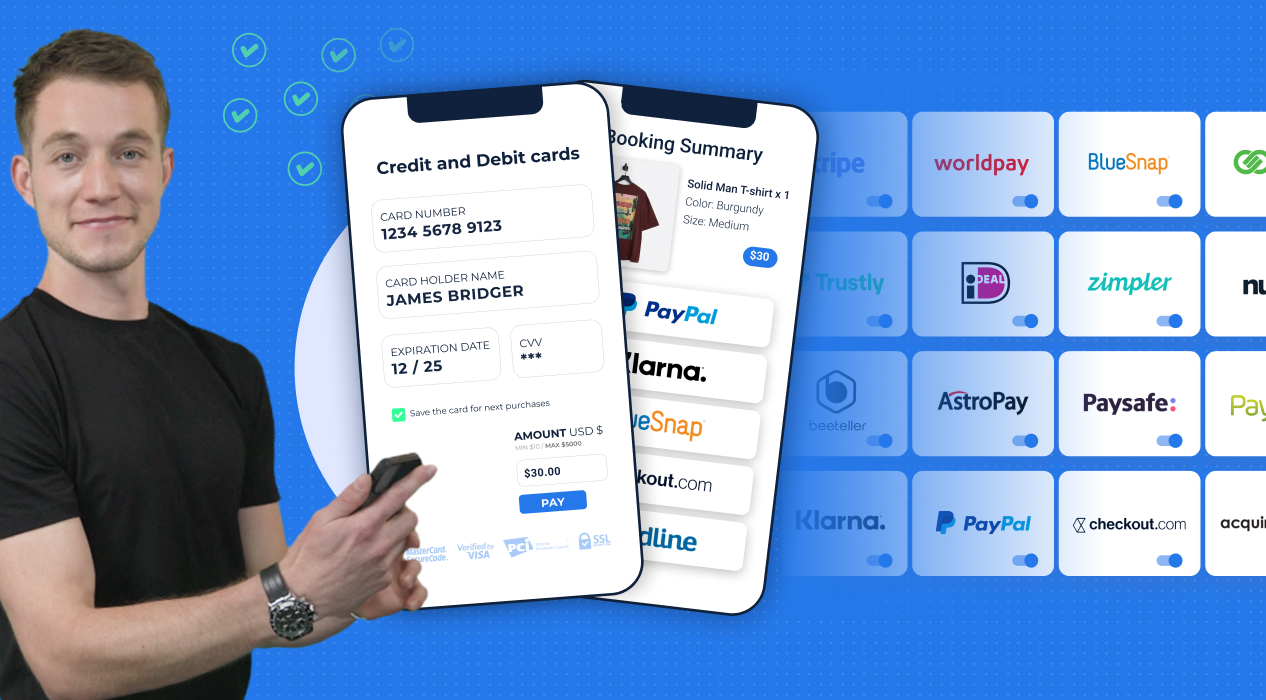

BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows, empowering ANY business.

What Payment Gateways are in eCommerce & Why You Need (at Least) One

Digitization has severely reduced (if not brought completely to an end) almost all the usual ways customers spend their money. For example, UK Finance reported that cash payments went down 16% from 2017 to 2018 and reported that they would decrease sharply by 2028. Today, people are used to and want to effortlessly pay online.

It doesn't take a rocket scientist to understand that, as a business, you need to offer relevant, easy, and trusted digital payment methods to your customers. This is where payment gateways come into play, they take care of the security side of things and allow you to easily offer card and other digital payments on your website.

Not only, but many gateways also offer reporting features (so you can keep track of your payment flows), fraud detection tools, and many other features to make your life easier.

In short, a payment gateway in eCommerce is a platform that allows you to accept online payments. It is a service that allows eCommerce sites to offer a secure payment interface, without the complications of in-house development, getting a Merchant Account, and worrying about PCI compliance.

It all sounds dandy until you start looking for a payment gateway that suits your needs and budget. There are thousands of payment gateways available worldwide, each with its own array of features. How to choose, then?

Continue reading to learn all about payment gateways and how to pick the one (or ones) that best fit your business needs.

What Is a Payment Gateway?

At its core, a payment gateway is a service that allows you to connect your store to a payment processor. It will securely handle all the technical details of receiving the payment details by:

- Providing an interface to input the payment details (this can be customized to match your brand's look and feel, or the payment gateway can be connected to your custom checkout form via API, for example)

- Encrypting the data and sending the payment information to the payment processor

- Relaying the result of the transaction back to you and your client

Having a payment gateway of some kind is mandatory if you want to accept online payments on your website because it acts as a physical POS card reader does in a shop.

Payment gateways are often offered directly by payment processors, which are licensed financial institutions. This means that they can help merchants accept credit card payments from customers and process refunds if necessary.

The fee structure of payment gateways usually follows one of two models:

- Fixed fee + a percentage of the transaction's value (for example, currently Stripe charges 30¢ + 2.9% in the US)

- A SaaS-like monthly subscription plan (like we do at BridgerPay)

In addition to their core functionality, payment gateways often have many features (e.g., reporting, advanced notifications, payment routing), but they all have one thing in common: they are used by merchants who want to accept payments online.

How Does a Payment Gateway Work?

As we have seen, a payment gateway is a system that allows you to accept digital payments from customers.

We won't get into all the technical details and security requirements (for example, PCI CSS) that a payment gateway needs to satisfy in order to work properly and securely, but this is a quick step-by-step rundown of how payment gateways work:

- The end-user decides to checkout and is presented with a form to enter his card and personal details (or any necessary details if the payment gateway works with an eWallet like PayPal or Klarna)

- The data is encrypted and passed on to the payment processor.

- Important! Very often processor and gateway are used interchangeably because most processors offer their own gateway solution, but the two systems are different!

- The payment processor relays the information (encrypted again) to the acquiring and issuing banks and facilitates the exchange of funds

- The payment gateway receives the result of the transaction from the payment processor (successful/unsuccessful) and notifies the merchant and the customer

Payment Gateways Vs. Payment Processors

Payment gateways and payment processors are two different things. By now it's clear that the payment gateway is the middleman between the "front end" (you, the merchant, and your customers) and the payment processor, which in turn deals with the "back end" (the banks or financial institutions).

We have an article that goes very in-depth about the differences between payment gateways and payment processors, but here’s a quick comparison table between the two:

Types of Payment Gateways

In the hyper-competitive eCommerce environment, the UX is king. If the buying journey feels clumsy and slow, customers will simply look for a competitor that offers a better experience. The main advantage of using a good payment gateway is that customers can pay without having to leave your site, and follow redirects or pop-ups that ruin the payment experience.

There are many different types of payment gateways and they can handle transactions in different ways, so it's important to choose the right one for your business.

Here is a list of the types of payment gateways:

Hosted Payment Gateways

Hosted payment gateways used to be the most common type of payment gateway. They redirect the customer away from the online store and to the gateway's site to complete the payment, then they send the user back to the original website once the transaction has been completed.

They undoubtedly offer safe transactions, but the problem is that the payment page is often not customizable and, let's face it, looks ugly.

The main advantage is that there is virtually no setup, as everything happens away from your store.

Self-Hosted Payment Gateway

Self-hosted payment gateways are very similar to their hosted counterpart, with one major difference: they allow you full control over your payment flow, allowing your customers to complete a purchase directly on your website without being redirected. This offers an array of benefits, mainly:

- Faster checkout flow

- Cohesive payment experience, as you can usually easily customize the look and feel of a hosted payment gateway

One drawback is that you will likely have to do some development work and coding in order to implement a self-hosted payment gateway. If you are not a developer or you don't have an in-house team, this might come at a considerable cost.

Luckily more and more self-hosted gateways are now offering easy-to-install plugins for all major eCommerce platforms (e.g., WooCommerce, PrestaShop, Magento, etc.)

If you have your own custom website, you won't be able to use a plugin, but that's most likely a non-issue as you probably have access to developers.

API Payment Gateway

API Payment Gateways offer the ultimate flexibility in terms of accepting digital payments on your website.

Most likely, a payment gateway that offers API connectivity will also make its own checkout widget available to you to embed in your website, but you don't have to use it.

If you have the resources to develop your own checkout form, you can just call the API and handle the payment that way, controlling every step of the payment experience.

As awesome as it sounds, API payment gateways require development, and you as the merchant need to make sure that you are PCI DSS compliant and conform to the latest security guidelines and regulations.

Examples of Payment Gateways

As we have seen, payment gateways come in many shapes and forms. Let's give a few real-life examples to put everything in perspective. There are three main approaches to being a payment gateway:

- A non-financial institution that is connected to any number of payment processors.

- A financial institution with an acquirer network (i.e., an agreement with one or several banks to do the processing)

- A financial institution that doesn't have to have an acquirer network, for example, eWallets

1. BridgerPay

BridgerPay is a pure-breed gateway. Actually, it's better defined as a super-gateway or payment operations platform. BridgerPay is a non-financial institution, so in order to use their platform, you also need to have an agreement with at least one payment processor.

What sets BridgerPay and other super-gateways apart is that they can connect your store to any other payment gateway or payment processor you need in order to scale your business, whereas your standard payment gateway gives you access to just one payment processor.

Super-gateways allow merchants extreme flexibility with smart payment routing, real-time declined transactions retry technology, advanced reporting, and tokenization. All these features mean that payment operation platforms offer unlimited scalability to any merchant, making it possible to grow their payment stack along with their business.

BridgerPay can both be used with their PCI DSS checkout widget or through your own custom solution.

Pro tip: Having just one credit card processor means that you can't retry declined payments in real-time, which leads to lost revenue. A payment operations platform allows you to have multiple card processors and set fallback scenarios to automatically rescue failed transactions.

2. Stripe

Stripe is a payment gateway that allows businesses to accept payments online through their website or mobile app. It's one of the most popular options because it's easy to use and offers many different features for businesses including advanced fraud protection, fraud detection, and more.

Stripe also offers APMs (Alternative Payment Methods such as eWallets) through its API.

Stripe is also a licensed financial institution, so they have an acquirer network and can process credit card payments as well. This approach makes Stripe an aggregator (you can read more about aggregators in our article Payment Gateway Vs Payment Processor)

3. PayPal

Next up is PayPal. PayPal is another popular way for businesses to accept payments online through their website or mobile app. It's also easy to use, and a lot of people have a PayPal account. Although they do allow customers to pay via credit card through their interface, PayPal is known as an APM, which is in essence a wallet that can store monetary value (and can also be connected to a bank account).

PayPal also has its own Buy now, pay later solution called Pay in 4. You can learn everything there is to know about BNPL in our dedicated article.

How Much Does a Payment Gateway Cost?

If you're thinking about getting a payment gateway, we bet you are asking yourself some questions: how much does it cost to get started? What are the fees?

The short answer is: it depends. Different business needs will direct you towards different costs.

The fees that a payment gateway has can be broken down into two main categories:

- Fixed cost: a fixed amount that you pay for each processed transaction. For example, processing Mastercard cards with Mollie will currently cost you £0.20 for both local and cross-border cards

- Percentage fee: a fee based on the value of the transaction. Again, if we follow Mollie's example, they currently charge 1.2% for domestic cards and 2.9% for international

A different business model is a SaaS-like approach, where you pay a fixed monthly amount in a subscription-style agreement. You can check out BridgerPay's pricing page as an example.

To these fees, you may need to add situation-specific additional costs, such as currency exchange for cross-border payments. In fact, these exchanges are performed by Money Services Operators (MSOs) that charge an additional percentage fee on the value of the transactions. Again, you can read more about MSOs in our Payment Gateway Vs Payment Processor article.

Top-tip: If you know you'll handle lots of cross-border payments, we recommend either a payment operations platform like BridgerPay, or at least a payment processor that has its own MSO licenses to cut the transaction fees drastically.

How to Select the Right Payment Gateway for Your eCommerce Business?

Choosing the right payment gateway is an important decision for your eCommerce business, but can also be a daunting task, as there are so many out there.

If you're not sure where to start, the following are some factors that you should consider when choosing a payment gateway for your eCommerce business:

- The country where your business is registered (not all gateways accept all locations)

- Countries that the payment gateway supports. In the case of a gateway that is also an aggregator or a processor, also check how the currency exchange is handled, in order to avoid unnecessary fees

- Type of payment methods you want to accept. Is the gateway connected (or is able to connect) to all the methods you need to grow your business? Nowadays it's not enough to accept just credit cards, clients want to be able to use eWallets, BNPLs, Open Banking, etc.

Conclusion

To recap, payment gateways are used by businesses that sell products or services online and need to accept digital payments from their customers. They also provide refund management and other useful tools like reporting.

Talking about eCommerce, payment gateways are essential for such businesses because they help them keep track of transactions and ensure safe payments for customers.

Want to find the perfect payment gateway for your business? Head over to our Connections page and get in touch with them!