BridgerPay is the world’s first payment operations platform, built to automate ALL payment flows, empowering ANY business.

Payment Operations vs. Payment Orchestration: A Manifesto for True Innovation

Things are constantly changing in the world of payments, new platforms, providers, and solutions are born all the time. To help you navigate through this overwhelming amount of choices, the time has come to clarify why at BridgerPay we coined the term Payment Operations Platform, the philosophy behind it, and what differentiates us from all other platforms out there. So here it is, payment operations vs. payment orchestration (and the top 3 reasons why you shouldn’t stop at optimizing your checkout).

Payment Orchestration vs. Payment Operations, why it matters

As we have been saying all along, we like to do things differently. To put it simply, we don’t like to follow the trends, we like to make them.

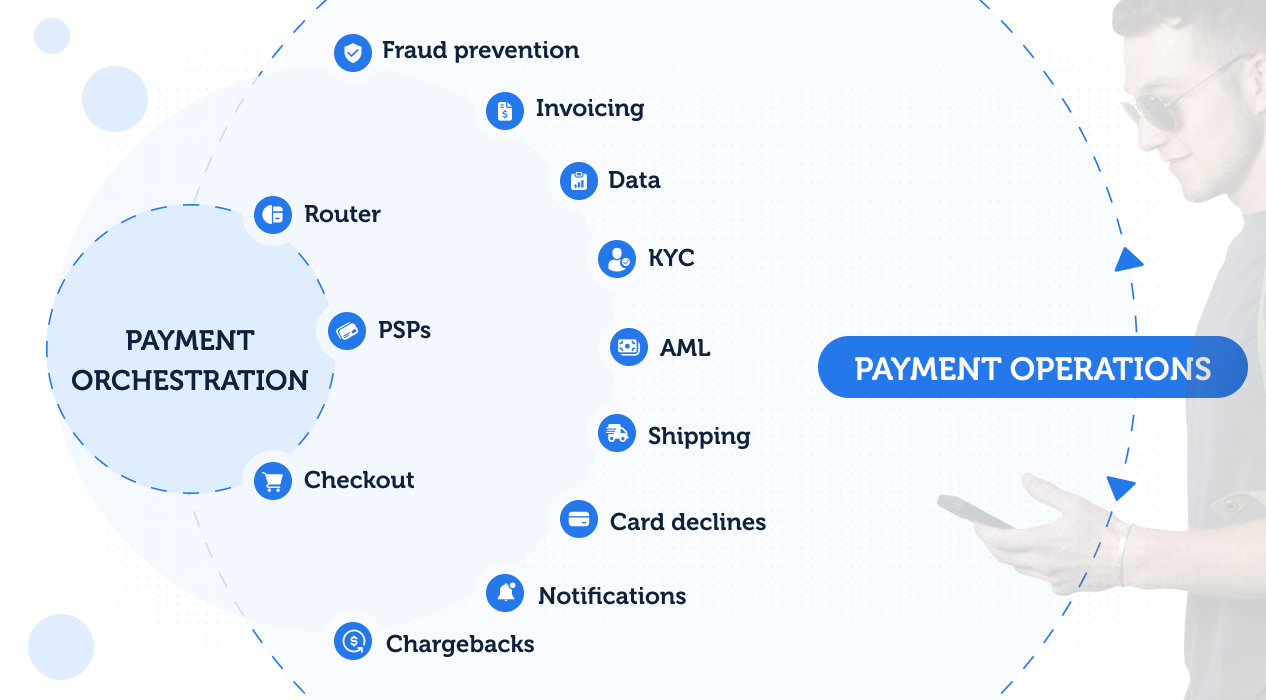

Payment orchestration is producing more and more buzz, it’s certainly a better way to handle payment processing, and there are a lot of solutions out there that can help with it. However, payment orchestration has one major flaw: it only deals with the checkout. There is no end-to-end automation of the payment process. We realized the need to do more, to go beyond orchestration: this is when we created a payment operations platform.

Payment operations encompass the whole payment ecosystem, from researching the best payment providers to reconciliation.

A clear differentiation between orchestration and operations is important, and it is this: payment orchestration is just a part of payment operations. In other words, with a payment operations platform you get payment orchestration, plus many, many other benefits.

Let us explore the three main ways in which payment orchestration and payment operations diverge.

1. Scope of Operation

A payment orchestration platform only gives the tools to send transactions to specific PSPs. Its scope of work is payment routing.

A payment operations platform is much more inclusive, it takes upon itself to automate the entire payment flow, including:

- Before the transaction (e.g., fraud prevention, KYC, AML, card declines, chargebacks)

- After the transaction (e.g., invoicing, shipping, data collection and analysis)

The final objective of payment operations is to give merchants one place to optimize the payment experience and everything that comes before and after.

2. Merchant Independence

We have been talking to businesses since the beginning, understanding their real needs. One thing we came across over and over is that merchants want to be able to do things themselves. They want to be able to act fast, without having to wait for another company to do their part.

One of the issues with payment orchestration platforms is that they are custom-made and take a long time to onboard, integrate, and set up any new merchant. Basically, every integration is done ad-hoc.

A payment operations platform is focused on keeping the merchant independent, as early as the onboarding phase. This is achieved through:

- A system of plugins that are easy to install, and straight-forward Web SDK and API

- Drag-and-drop, intuitive UI

- Thorough documentation

- World-class support and onboarding specialists for everything else

Payment operations give merchants full control over everything concerning their payments, without depending on a third party to get things done.

3. Innovation-driven

We believe that true innovation comes from companies that are willing to play high-stakes. In truth, the payment orchestration market is gradually approaching a plateau, where the many competitors are all offering more or less the same features.

This is when the shift from orchestration to operations needs to happen: only broadening the scope of the platform, true innovation can be achieved.

In our approach, we saw two ways of bringing revolutionary ideas about payments to life:

- Usage of data. Millions and millions of transactions go through our platform, we will be harnessing all this knowledge and put it to good use through Machine Learning and Artificial Intelligence (we announced our BrAIn project here). We are firmly convinced that the most impactful benefits from the payment industry will come from the democratization of data, giving all merchants the chance to optimize their payment stack through hard, tested data coming from the whole ecosystem.

- Fully agnostic ecosystem. Speaking of ecosystem, most payment orchestration platforms focus on a specific vertical (e.g., travel, hospitality, eCommerce, etc.) A payment operations platform can integrate easily into any tech-stack, even legacy ones. Innovation means flexibility. For example, at BridgerPay we developed an agile ecosystem, which can easily slot into any business logic and enhance it from day-one.

- Multiple interfaces. Just like verticals, payment orchestration platforms tend to focus on just one payment interface. On the other hand, payment operations deal with all interfaces, which can be controlled and optimized from a single platform (e.g., embed, MPI, POS, mobile payments).

Conclusion and Bottom Line

So here it is. The three guidelines that we’ll follow to lead innovation in the payment space:

- Encompassing the whole payment flow, from the very beginning until data analysis and optimization

- Merchant independence, to avoid being a bottleneck with the business process. At the same time, we will be present and solve any issues promptly

- Innovation for all, we will bring the latest technology to our whole ecosystem, allowing businesses from any vertical to become the most performing version of themselves

Lastly, we’ll always stay open to feedback, suggestions, and the needs of our merchants. We want to make you scale, hence we’ll build anything you need to do so.